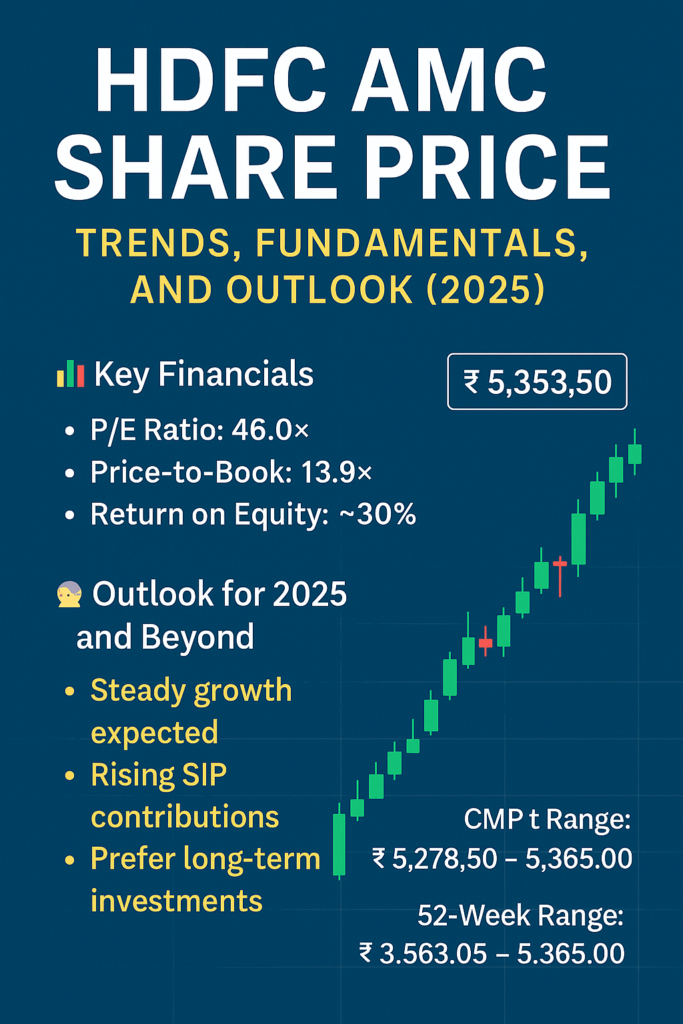

HDFC Asset Management Company (HDFC AMC), one of India’s leading mutual fund houses, has witnessed a sharp uptrend in its share price in recent months. As of today, the stock is trading around ₹5,353.50, very close to its 52-week high of ₹5,365. This surge reflects not only the broader bullish market sentiment but also the strong fundamentals and consistent financial

HDFC AMC Share Price Movement

- Current Market Price (CMP): ₹5,353.50

Today’s Range: ₹5,278.50 – ₹5,365.00- 52-Week Range: ₹3,563.05 – ₹5,365.00

- Market Cap: ~₹1.13 lakh crore

https://digitalinternational.in/

Company Overview

HDFC AMC is a joint venture between HDFC Ltd (now merged with HDFC Bank) and abrdn Investment Management. It offers a wide range of mutual fund products across equity, debt, and hybrid categories. With a strong brand and distribution network, it has consistently maintained its leadership position in the Indian mutual fund industry.

The stock has gained more than 40% in the past year, outperforming many of its peers in the asset management space.

Why Is HDFC AMC Stock Rising?

Robust Mutual Fund Inflows – Monthly SIP contributions crossed ₹20,000 crore in early 2025, boosting AUM growth.

High Operating Leverage – As AUM grows, margins expand due to low incremental costs.

Strong Brand and Network – HDFC’s reputation and deep distribution ensure retail penetration across Tier 2 & 3 cities.

Positive Regulatory Environment – SEBI’s push for investor education and fintech inclusion is benefiting AMCs

https://digitalinternational.in/

Outlook for 2025 and Beyond

It is believed that HDFC AMC will continue to grow at a steady pace, driven by India’s growing middle class, digitalization in services and growing awareness about wealth creation through mutual funds. With markets expected to remain volatile due to indications, investors may prefer SIPs and long-term equity investments, which will directly benefit AMCs like HDFC.

DIGI MERCH STORE PRINT ON DEMAND

Should You Invest?

While HDFC AMC offers solid fundamentals and leadership, its high valuation (P/E ~46) suggests limited short-term upside unless earnings surprise positively. That said, it remains a strong long-term investment candidate for those seeking consistent returns, dividends, and exposure to India’s growing financial sector

https://digitalinternational.in/

Final Thoughts

HDFC AMC continues to be a bellwether in the Indian asset management space. Its recent rally reflects the market’s confidence in its business model and growth prospects. Investors looking for a defensive yet growth-oriented stock should consider keeping it on their watchlist or portfolio—especially during market corrections

Comment: