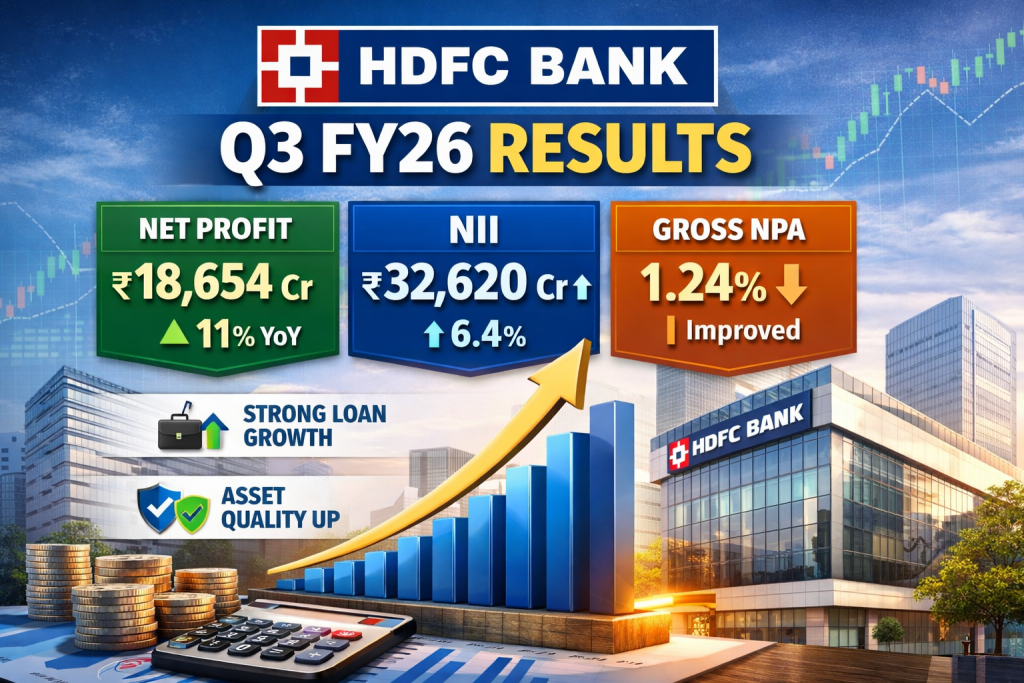

HDFC Bank, India’s largest private sector bank, announced its Q3 FY26 results (quarter ended December 31, 2025), delivering a resilient financial performance amid a challenging interest rate and cost environment. The bank reported double-digit growth in net profit, stable margins, improving asset quality, and consistent expansion in loans and deposits, reinforcing its long-term growth outlook.

HDFC Bank posted a net profit of ₹18,653.75 crore, marking an 11–11.5% year-on-year (YoY) growth compared to ₹16,735 crore in Q3 FY25. The profit figure beat market expectations, supported by lower provisions and steady operating performance The bank’s net interest income rose by ~6.4% YoY to around ₹32,620 crore, reflecting healthy growth in the loan book despite margin moderation. Lending income remained robust across retail, SME, and corporate segments Net Interest Margin (NIM) 3.35% on total assets 3.51% on interest-earning assets

Loan Growth & Deposit Expansion Advances Growth Gross advances grew ~11.9% YoY Growth was driven by Retail loans (home loans, personal loans, auto loans) SME and commercial banking Select corporate lending The bank maintained a prudent balance between growth and asset quality, avoiding aggressive risk-taking. Deposit Growth Total deposits increased ~11.6% YoY CASA (Current Account Savings Account) deposits continued to expand, helping manage funding costs

Asset Quality Shows Clear Improvement One of the biggest positives in HDFC Bank’s Q3 FY26 performance was improving asset quality. Gross NPA: 1.24% (vs 1.42% YoY) Net NPA: ~0.42% Provisions: Declined ~10% YoY Lower slippages, better recoveries, and disciplined credit underwriting helped the bank strengthen its balance sheet. The improvement also led to reduced credit costs, directly supporting profitability.

Operating Expenses & Cost Trends Operating expenses rose during the quarter due to: Wage revisions Labour code compliance costs Continued investments in technology and branch expansion While cost pressures impacted short-term profitability, these investments are expected to support long-term growth and operational efficiency. HDFC Bank continues to maintain strong capital adequacy, with healthy CET1 ratio Tier-1 capital levels

Stock Market Reaction & Analyst View Market experts viewed HDFC Bank’s Q3 FY26 results as stable and reassuring Profit growth exceeded expectations Asset quality improved consistently Loan and deposit growth remained balanced However, analysts remain cautious on near-term margin pressure due to elevated deposit costs. Long-term sentiment remains positive due to HDFC Bank’s strong fundamentals and leadership position in the Indian banking sector.

DIGI MERCH STORE PRINT ON DEMAND

Management Commentary & Outlook Management highlighted Focus on profitable growth rather than aggressive expansion Continued emphasis on risk management Expectation of margin normalization in coming quarters The bank remains optimistic about credit demand in FY26, supported by economic growth, infrastructure spending, and rising consumer demand.

HDFC Bank’s Q3 FY26 results reaffirm its status as a fundamentally strong and resilient bank. With 11%+ profit growth, improving asset quality, stable loan expansion, and strong capital buffers, the bank is well-positioned to navigate near-term challenges and deliver sustainable long-term growth For long-term investors, HDFC Bank continues to remain a core banking stock, backed by consistent performance, prudent management, and a diversified business model.

hdfcbanknetprofit dailyprompt-2116

hdfcbankq3results dailyprompt-2110

hdfcbankshareprice dailyprompt-2120

bankingsectorq3results dailyprompt-2114

hdfcbankearningsimpact dailyprompt-2143

Comment