The Employees’ Provident Fund Organisation (EPFO) is moving towards a major digital upgrade that could transform how salaried employees access their provident fund money. Under the proposed EPFO UPI Withdrawal system, PF members will be able to withdraw their funds instantly using UPI (Unified Payments Interface), eliminating long claim processing times and paperwork. This initiative is part of EPFO’s broader digital reform strategy, often referred to as EPFO 3.0, aimed at faster, simpler, and more transparent services.

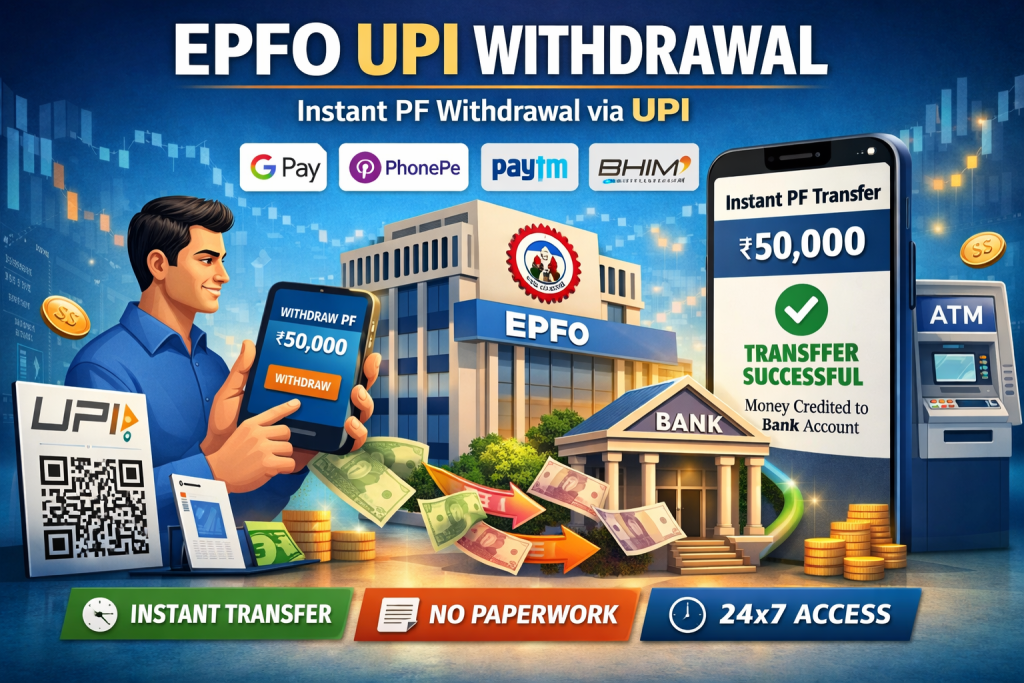

What Is EPFO UPI Withdrawal? EPFO UPI Withdrawal is a proposed facility that will allow EPF members to withdraw a portion of their PF balance directly through UPI-enabled apps such as Google Pay, PhonePe, Paytm, and BHIM. Instead of waiting several days for claim settlement, members may receive PF money instantly or within a few hours, similar to regular UPI transactions.

Why EPFO Is Introducing UPI Withdrawals EPFO currently serves over 7 crore active members, and PF withdrawals often face delays due to verification and banking processes. UPI integration aims to Reduce claim settlement time Minimize manual intervention Improve user experience Enable 24×7 fund access Lower rejection rates due to banking errors Expected Launch Timeline The UPI withdrawal feature is expected to roll out in phases Initial implementation is likely for partial withdrawals Nationwide availability may follow after successful pilots

How EPFO UPI Withdrawal Is Expected to Work UAN linked with Aadhaar and bank accoun UPI ID linked to the same bank account Login to EPFO Member Portal or UMANG App Select UPI Withdrawal option Enter withdrawal amount Authenticate using UPI PIN Money credited instantly to the linked bank account Eligibility Criteria (Expected) To use EPFO UPI withdrawal, members must Have an active UAN Complete KYC verification (Aadhaar, PAN, Bank) Link bank account with UPI Meet EPFO’s existing withdrawal rules

DIGI MERCH STORE PRINT ON DEMAND

Benefits of EPFO UPI Withdrawal Instant access to PF money No paperwork or physical verification Faster than NEFT/RTGS settlements Reduced dependency on employer approval Improved transparency and tracking Important Things to Know UPI withdrawal will not change EPFO rules related to retirement, service years, or tax Full PF withdrawal rules remain unchanged Traditional claim methods will continue alongside UPI Feature will be activated gradually, not all members at once

How to Prepare Now Update Aadhaar, PAN, and bank details on EPFO portal Ensure your mobile number is linked to Aadhaar Use a bank account that supports UPI transactions Regularly check updates on the EPFO or UMANG app The EPFO UPI Withdrawal system marks a significant step toward digital empowerment of India’s workforce. Once fully implemented, it could drastically reduce withdrawal time and make PF access as easy as sending money via UPI.

EPFOPFwithdrawal. Partyinvitations

EPFOUPIwithdrawal. Instagramposts

Comment