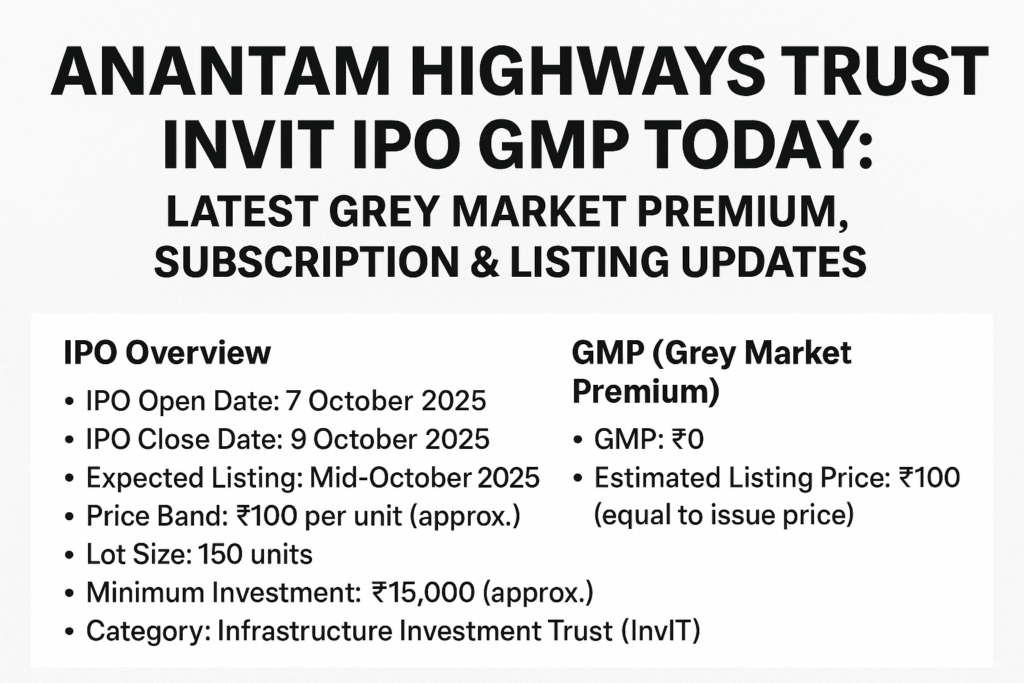

The Anantam Highways Trust InvIT IPO has opened for subscription and is drawing attention from investors interested in infrastructure and long-term yield assets. Let’s take a closer look at the IPO details, grey market premium (GMP), and expected listing performance

IPO Overview

The Anantam Highways Trust InvIT (Infrastructure Investment Trust) focuses on the operation and maintenance of national highways and toll roads across India. This InvIT offers investors exposure to a portfolio of stable, income-generating infrastructure assets backed by long-term concession agreements

- IPO Open Date: 7 October 2025

- IPO Close Date: 9 October 2025

- Expected Listing: Mid-October 2025

- Lot Size: 150 units

- Minimum Investment: ₹15,000 (approx.)

- Category: Infrastructure Investment Trust (InvIT)

GMP (Grey Market Premium)

As per the latest market updates (as of 7 October 2025), the Anantam Highways Trust IPO GMP stands at ₹0, indicating no major premium or discount in the unlisted grey market.

This suggests that the IPO is being perceived as a long-term yield play rather than a short-term listing gain opportunit

Current GMP Trend:

- GMP: ₹0

- Estimated Listing Price: ₹100 (equal to issue price)

- Sentiment: Neutral to Positive (for long-term investors)

Subscription Status

Early data shows steady participation from institutional investors and moderate response from retail investors

- Day 1 Subscription: 0.45x overall (indicative)

- Expected Total Subscription: Likely between 1.2x – 1.8x by close of issue

Institutional investors are focusing on stable yield and predictable cash flow, making this a preferred choice for conservative portfolios.

About the InvIT

Anantam Highways Trust InvIT manages a network of national highway projects under NHAI authority, ensuring consistent toll revenue. The trust aims to distribute regular income to unit holders, making it similar to dividend-yielding investments like REITs and bonds.

DIGI MERCH STORE PRINT ON DEMAND

Listing Expectations

Given the flat GMP and steady institutional demand, analysts expect a neutral to slightly positive listing, with a possible small premium on the debut day if subscription improves

Should You Invest?

This IPO may not deliver immediate listing gains, but it offers steady annual returns through yield distribution, backed by long-term infrastructure contracts.

Ideal for investors seeking income stability, long-term capital protection, and exposure to India’s infrastructure growth story.

Conclusion

The Anantam Highways Trust InvIT IPO reflects India’s growing infrastructure investment ecosystem. While the GMP remains at ₹0, indicating limited short-term excitement, its long-term fundamentals make it an attractive option for income-focused investors.

IPOgreymarketpremium. dailyprompt

AnantamHighwaysTrustIPO. YouTubeintros

AnantamHighwaysInvITGMP. channelart

AnantamHighwaysGMPtoday. Gadgetslogo

AnantamHighwaysIPOlistingdate. TechTips

Comment