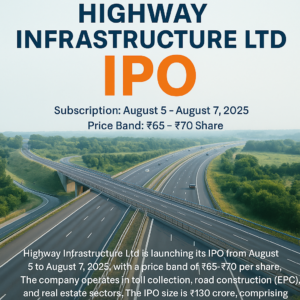

Highway Infrastructure Ltd is launching its IPO from August 5 to August 7, 2025, with a price band of ₹65–₹70 per share. The company operates in toll collection, road construction (EPC), and real estate sectors. The IPO size is ₹130 crore, comprising a fresh issue of ₹97.5 crore and an offer-for-sale of ₹32.5 crore.

The funds raised will be used for working capital needs and general corporate purposes. With a GMP of ₹40, the IPO is attracting strong investor interest, already oversubscribed within hours of opening. The shares are set to list on August 12, 2025 on NSE SME

The company has an order book of ₹666 crore, operates across 11 states, and leverages modern tolling technologies like FASTag and ANPR systems. Despite a dip in revenue in FY25, its profitability has improved slightly.

Strengths & Risks

Strengths

- Govt-backed projects via NHAI; strong track record in toll and EPC operations

- Adoption of advanced digital tolling yields better efficiency and revenue assurance.

- Diversified across highways, construction, and some real estate

Risks

- Recent revenue decline from ₹576 crore (FY24) to ₹504 crore (FY25), though profitability improved marginally.

- Dependency on highway/toll regulations and traffic patterns, making it sensitive to macroeconomic trends

- Limited scale relative to major infrastructure peers

Company Background

Operates in tollway collection, EPC (engineering, procurement & construction), and real estate across India. Uses advanced ANPR and RFID-based FASTag systems for tolling. Active across 11 states and 1 Union Territory

As of May 31, 2025: ₹666 crore order book, consolidated revenue ~₹504.5 crore (FY25), profit ~₹22.4 crore (5% YoY increase, despite revenue dip)

DIGI MERCH STORE PRINT ON DEMAND

Use of Proceeds

Fresh issue funds earmarked for working capital (₹65 cr) and general corporate purposes. OFS proceeds go to selling promoters

Should You Apply?

This IPO is generating strong buzz, backed by hefty GMP and early oversubscription. For long-term investors

Moderate pricing within ₹65–70.

Long runway in India’s toll‑way expansion under government programs

#HighwayInfrastructureIPO.

#HighwayInfrastructureLtdIPO.

#HighwayInfrastructureIPOreview.

#UpcomingIPOinAugust.

Comment: