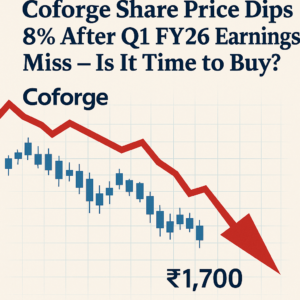

Coforge Ltd., a leading IT services company, witnessed a sharp decline in its share price on July 24, 2025, as investors reacted to its Q1 FY26 earnings that fell short of market expectations. The stock slipped nearly 8–9% intraday, trading around ₹1,700, as the company reported a contraction in operating margins despite healthy revenue growth

Q1 FY26 Results Overview

Coforge reported a revenue of ₹3,689 crore, reflecting an 8.2% sequential growth, while its net profit came in at ₹317 crore, up 21–22% quarter-on-quarter. Although revenue growth was strong, the net profit missed analyst estimates by about ₹18 crore, leading to a negative reaction in the stock market

Key Highlights:

Operating margin pressure: Higher employee costs and currency fluctuations dented margins.

Order book strength: The company maintained a $1.54 billion executable order book, indicating strong business visibility.

Deal pipeline: Coforge continues to win significant digital transformation deals, particularly in BFSI and travel verticals.

Market Reaction

The broader IT sector was under pressure on July 24, with Coforge and other mid-cap IT stocks dragging the Nifty IT Index down by nearly 1%. Analysts believe the earnings miss, coupled with global IT demand uncertainties, triggered profit-booking in Coforge shares.

https://digitalinternational.in/

Analyst Views

Morgan Stanley retained its “Overweight” rating with a target price of ₹1,880, citing a strong order book and digital capabilities

Other analysts, however, have revised short-term earnings forecasts due to margin pressures.

DIGI MERCH STORE PRINT ON DEMAND

Should You Buy, Sell, or Hold?

Coforge’s long-term growth story remains intact due to its diversified client base, strong digital offerings, and robust deal pipeline. However, short-term volatility is likely due to margin pressures and global economic uncertainties. Investors with a long-term view may consider accumulating the stock on dips, while short-term traders should watch for technical support levels around ₹1,650–₹1,670.

https://digitalinternational.in/

Conclusion

The sharp fall in Coforge’s share price post Q1 FY26 earnings reflects investor disappointment over the profit miss and margin contraction, but the company’s fundamentals remain strong. With digital transformation and automation trends fueling demand, Coforge could bounce back once margins stabilize and new deal wins are executed effectively

Comment: