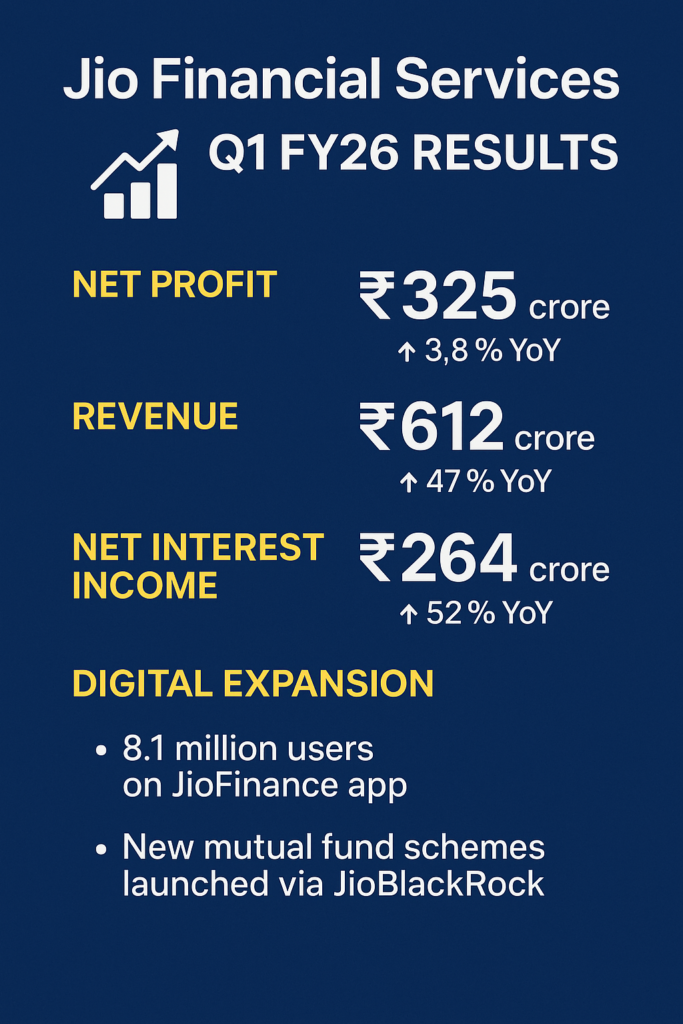

Jio Financial Services Q1 FY26 Results:

Jio Financial reported a net profit of ₹325 crore, up 3.8% YoY, with revenue surging 47% to ₹612 crore. Net Interest Income rose 52% to ₹264 crore. The company expanded its digital footprint with 8.1 million users on the JioFinance app and launched new mutual fund schemes via JioBlackRock

Here are the Q1 FY26 (quarter ended )

Net Profit (PAT): ₹325 crore, up 3.8% year‑on‑year from ₹313 crore in Q1 FY25

Revenue from Operations: ₹612 crore, marking a 47% increase YoY compared to ₹418 crore last year

Net Interest Income (NII): ₹264 crore, a strong 52% YoY rise

Total Expenses: ₹261 crore, substantially higher than ₹79 crore in Q1 FY25

Growth & Strategic Highlights

JioFinance App: Averaged 8.1 million monthly active users in Q1 FY26

JioBlackRock Mutual Fund: Launched three new debt and money-market funds, raising ₹17,800 crore in the initial NFO period (June 30–July 2)

Expansion: Jio Credit now operates in 11 cities

Subsidiary Acquisition: Acquired SBI’s 14.96% stake in Jio Payments Bank for ~₹105 crore, making it a wholly-owned subsidiary. As of June 30, JPBL had 2.58 million customers and deposits of ₹358 crore

https://digitalinternational.in/

Sequential Performance (QoQ)

PAT rose ~3% from ₹316 crore in Q4 FY25 to ₹325 crore

Revenue grew ~24% sequentially from ₹493 crore to ₹612 crore

DIGI MERCH STORE PRINT ON DEMAND

Analyst Commentary

Analysts expect the strategic tie-up with BlackRock, expansion in lending, insurance, broking, and asset management to support long-term momentum. Near-term EPS growth may be affected by rising expenses and investment in new services

https://digitalinternational.in/

Bottom Line

Jio Financial delivered a healthy quarter with strong revenue and interest income growth, alongside continued user and service expansion. While elevated expenses weighed on margins, the firm is investing heavily in scaling its digital financial ecosyste

Comment: