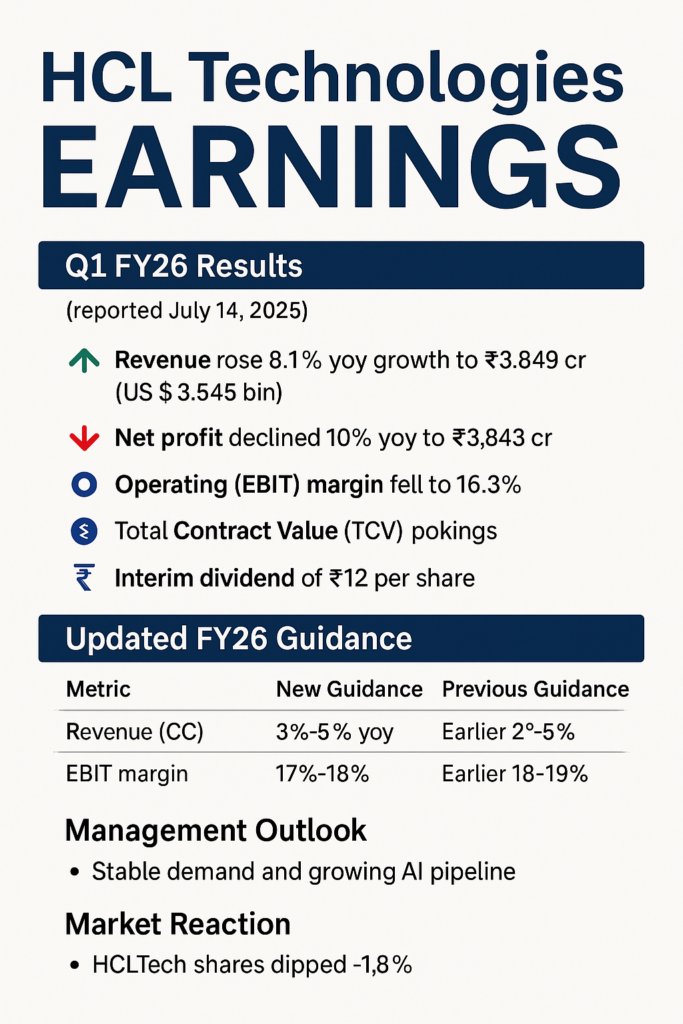

HCL Technologies (NSE: HCLTECH) released its Q1 FY26 results on July 14, 2025. The company reported an 8.1% year-on-year (YoY) revenue growth, beating market estimates, but faced a 10% YoY drop in net profit, primarily due to margin pressure and one-off client impacts. Let’s explore the key numbers, guidance, and market reaction in detail.

Profitability Under Pressure

Despite top-line growth, HCL’s operating profit margins slipped by 80 basis points to 16.3%, mainly due to:

- Increased investments in GenAI, cloud, and go-to-market strategies

- Lower utilization rates

- A one-time impact due to a client bankruptcy (~20 bps)

AI & Digital: Growth Engines Ahead

A growing pipeline of GenAI projects

Strategic partnerships with OpenAI and Microsoft Azure

Continued recognition in analyst reports like Gartner and IDC

https://digitalinternational.in/

Market Reaction

HCLTech shares slipped 1.8% post-earnings, reflecting investor concerns over margin compression. Analysts remain divided

Bullish View: Strong demand in digital & cloud, attractive dividend

Bearish View: Falling margins, weak TCV growth

DIGI MERCH STORE PRINT ON DEMAND

Conclusion: What Lies Ahead for HCLTech?

HCLTech’s Q1 FY26 was a mixed bag — while revenues grew steadily, the profitability challenges signal a cautious outlook. However, with AI-led services, strong partnerships, and consistent deal wins, HCLTech remains well-positioned for long-term growth

https://digitalinternational.in/

SEO Keywords

HCL Technologies Q1 FY26 Results, HCLTech Earnings July 2025, HCL Profit and Revenue, HCL Technologies Dividend July 2025, HCLTech Share Price Update, HCL FY26 Guidance, HCL Technologies Financial Report

Comment: