Titan Company Ltd — a Tata Group jewel and a bellwether of India’s luxury retail sector — saw its stock nosedive over 6% on July 8, 2025, following a disappointing Q1 business update that failed to meet investor expectations

https://digitalinternational.in/

Titan Stock Performance Today

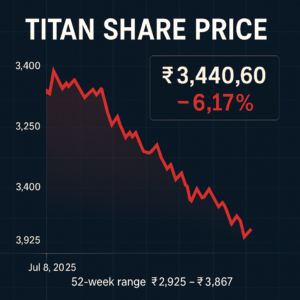

As of Tuesday’s closing, Titan’s share price fell by 6.17% to settle at ₹3,440.60 on the NSE. The stock opened weak and remained under selling pressure throughout the session, erasing nearly ₹16,000 crore in market capitalisation in a single day.

This marks one of the sharpest single-day drops for Titan in recent months and comes despite its strong run earlier in the year when the stock touched a 52-week high of ₹3,867.

What Went Wrong?

Jewellery Division: Grew 18% YoY — below market expectations of 22–23%.

Watches & Wearables: Continued healthy growth, but still a smaller contributor

Eyewear & Emerging Businesses: In line with estimates but failed to offset jewellery segment disappointment

https://digitalinternational.in/

Big Investors Also Take a Hit

The steep fall also impacted prominent shareholders. The Jhunjhunwala family, known for their long-standing stake in Titan, reportedly saw a ~₹900 crore decline in the value of their holdings due to Tuesday’s fall alone.

Despite this, many long-term investors remain bullish, citing Titan’s strong brand equity, retail expansion strategy, and premium product portfolio.

DIGI MERCH STORE PRINT ON DEMAND

Market Experts’ Take

Brokerage View: Some analysts have trimmed short-term price targets but retained Titan as a ‘Buy’ with a long-term view.

Technical Outlook: Immediate support is seen near ₹3,400; breach of this could lead to further downside towards ₹3,250.

https://digitalinternational.in/

What to Watch Ahead

Gold price fluctuations

Consumer demand trends in Tier 1 and Tier 2 cities

Titan’s upcoming launches in smart wearables and eyewear

Comment: