India’s largest private sector lender, HDFC Bank, announced its Q2 FY26 (July–September 2025) results, reporting a steady performance despite margin pressure and higher provisioning. The bank’s profit growth was driven by strong loan expansion and improved asset quality, though net interest margins remained under slight pressure.

Financial Performance

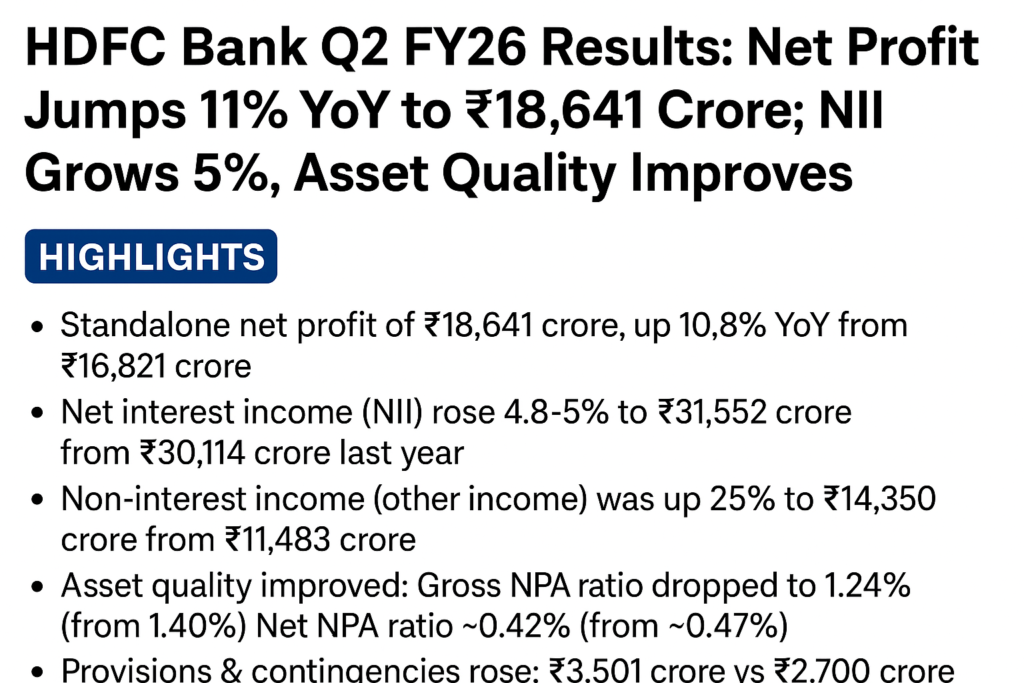

HDFC Bank’s standalone net profit rose 10.8% year-on-year to ₹18,641 crore, compared to ₹16,821 crore in the same quarter last year. The growth came on the back of healthy advances, strong fee income, and stable operating performance.

The bank’s net interest income (NII) — the difference between interest earned and paid — grew around 5% YoY to ₹31,552 crore, supported by consistent loan growth. However, a slight decline in net interest margin (NIM) to 3.3% from 3.5% last year indicated rising funding costs

Other Income and Provisions

Non-interest income (also known as other income) saw a strong 25% jump, reaching approximately ₹14,350 crore, up from ₹11,483 crore a year ago. This included robust growth in fee, commission, and trading income.

On the flip side, the bank’s provisions and contingencies increased to ₹3,501 crore, compared to ₹2,700 crore in the previous year, reflecting a more cautious approach toward asset quality amid a volatile macroeconomic environment.

Asset Quality Improves

- Gross NPA ratio improved to 1.24% from 1.40% last year

- Net NPA ratio declined to 0.42% from 0.47%.

This indicates stronger credit monitoring and healthier loan book quality despite a challenging interest rate environment.

Loan and Deposit Growth

HDFC Bank continued to show strong growth in its loan and deposit base. The bank’s total advances rose by over 13%, driven by robust demand in both retail and corporate segments. Deposits also grew by around 12%, supported by traction in term deposits as customers preferred fixed returns amid volatile markets.

DIGI MERCH STORE PRINT ON DEMAND

Management Outlook

The bank’s management stated that focus remains on maintaining a balance between growth and asset quality while managing margin pressures effectively. HDFC Bank aims to strengthen its retail and digital banking presence further, leveraging its wide network and technological capabilities.

Market Reaction

Following the announcement, HDFC Bank’s stock traded moderately higher, as investors reacted positively to the stable earnings and improved asset quality. However, analysts pointed out that margin compression and higher provisions could pose short-term challenges

Conclusion

HDFC Bank’s Q2 FY26 results reflect a resilient and stable performance with healthy profit growth, improved asset quality, and a growing customer base. While margin pressures continue due to rising costs, the bank’s diversified income streams and prudent risk management keep it well-positioned for sustainable long-term growth

HDFCBankearningsreport. dailyprompt–211

HDFCBankQ2FY26profit. Websitebanners

HDFCBanknetprofit. Partyinvitations

HDFCBankquarterlyresults. SmartHome

HDFCBankQ2FY26resultsfull. TechTips

Comment