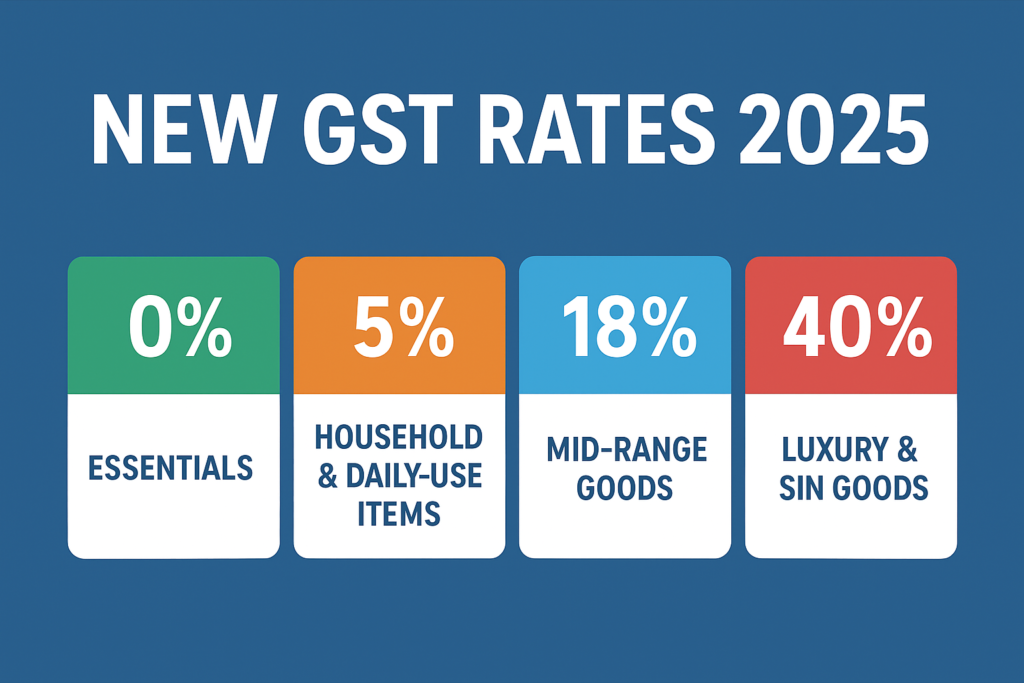

The Goods and Services Tax (GST) Council has introduced a major revamp in India’s GST system, simplifying the structure and reducing multiple slabs into just a few. Effective from September 22, 2025, the new GST framework aims to boost consumption, ease compliance, and reduce prices for middle-class households, while keeping luxury and sin goods under heavy taxation.

GST Rates by Category

- 0% (Nil Rate) – Essentials

- Life-saving medicines (cancer, rare disease drugs)

- Individual life & health insurance

- UHT milk, paneer, parathas, chapatis

- School stationery (pencils, erasers, notebooks)

5% – Household & Daily-Use Items

- Packaged food (butter, cheese, fruit juices, pasta)

- Toiletries (soap, shampoo, toothpaste, hair oil)

- Kitchenware & tableware

- Bicycles and parts

- Medical devices & spectacles

- Agricultural equipment (tractors, drip irrigation machines, fertilizers)

18% – Mid-Range Goods

- Electronics (TVs, ACs, dishwashers)

- Small cars (petrol up to 1,200 cc, diesel up to 1,500 cc, under 4 m length)

- Two-wheelers under 350 cc

- Auto parts, cement, and household appliances

DIGI MERCH STORE PRINT ON DEMAND

40% – Luxury & Sin Goods

- Luxury and mid-size cars (over 1,500 cc or longer than 4 m)

- Tobacco and cigarettes

- Carbonated and aerated drinks

- Casino and lottery services

Why This Change Matters

Easier Compliance – With fewer slabs, businesses face less confusion in billing and filing returns.

Consumer-Friendly – Middle-class families benefit as essentials and packaged goods become cheaper.

Boost to Demand – Lower GST on small cars, two-wheelers, and home appliances will likely push festive sales.

Targeted Taxation – Harmful and luxury goods continue to attract high rates, ensuring revenue balance.

GSTratechangesIndia Partyinvitations

GSTCouncilmeeting DigitalMarketing

GSTondailyessentials PinterestpinsFlyers

Comment